With the prices of smartphones rising, even a small repair can cost hundreds of pounds. This is where mobile phone insurance steps in, by providing financial protection against the unexpected.

This content will explore how to get the best mobile phone insurance in the UK. Whether you are worried about accidental damage, theft, or loss, this guide will help you make an informed decision that’s best suited to your needs.

Why do I need Mobile phone insurance?

- High Repair Costs: The cost of mobile phone repairs in the UK can be staggering, particularly for high-end models like the iPhone or Samsung Galaxy series. For instance, replacing a cracked screen can easily cost upwards of £150, with newer models potentially exceeding £300 for repairs. Insurance can help mitigate these expenses, especially as repair costs have surged by over 20% in the past five years.

- Common Risks: Our phones face various risks daily—accidental drops, water damage, and theft are some of the most common. With mobile phone theft in London alone rising by 25% in recent years, having insurance can be a lifesaver. Whether it’s an accidental slip into a puddle or the unfortunate event of a pickpocket incident, insurance can provide valuable peace of mind.

- Peace of Mind: Mobile phone insurance in the UK offers a safety net, ensuring that if your phone is damaged, lost, or stolen, you won’t be left with an expensive bill. Whether you’re dealing with accidental damage or theft, insurance helps cover the financial blow, keeping you connected without breaking the bank.

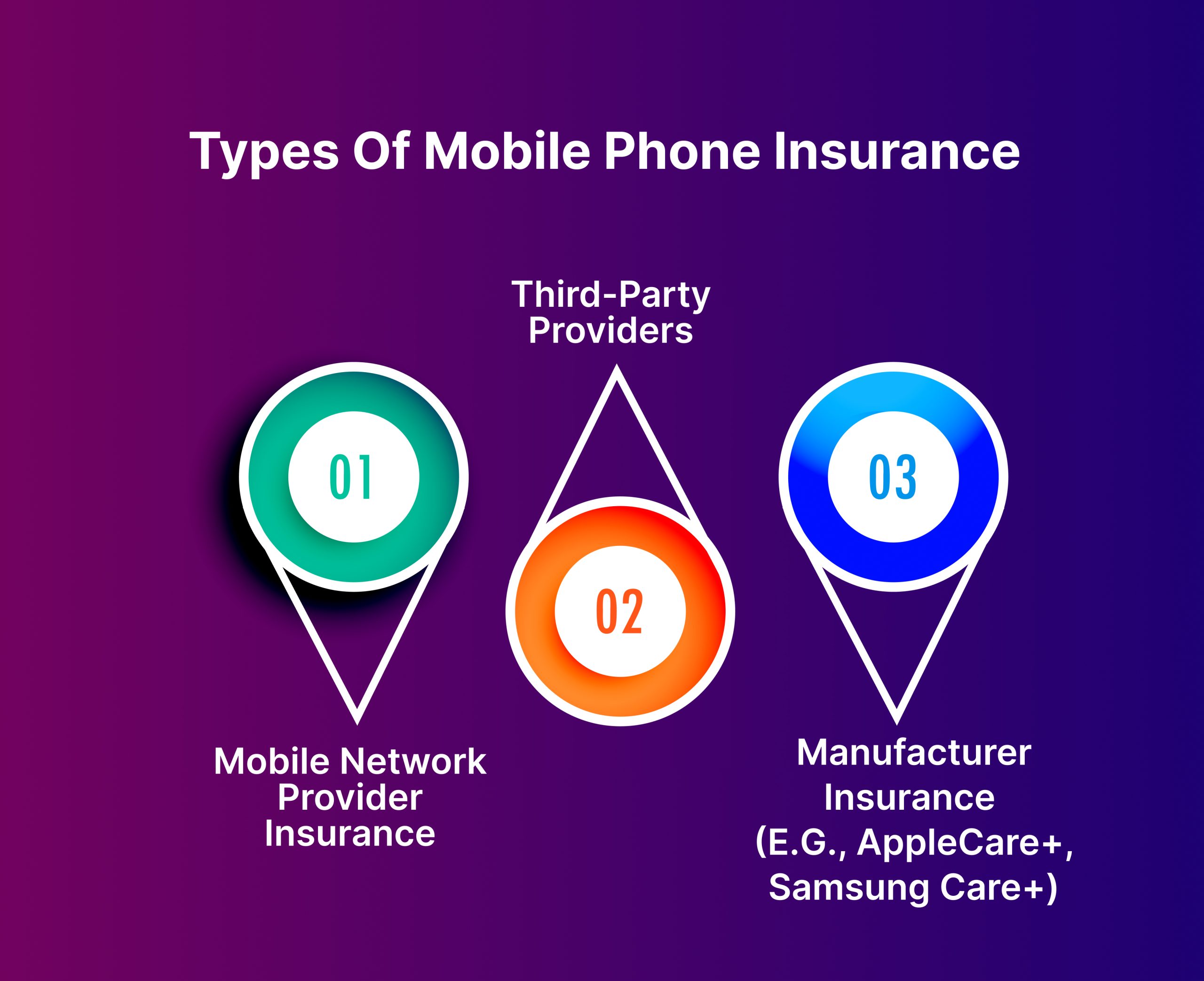

Types of Mobile Phone Insurance

There are various types of mobile phone insurance available to users

- Mobile Network Provider Insurance

Major UK mobile networks like EE, O2, Vodafone, and Three offer their own mobile phone insurance plans. These policies typically cover accidental damage, theft, and sometimes loss. Examples include Vodafone’s Insurance and EE’s Full Cover. These plans are convenient to bundle with your mobile contract but may come with higher premiums and excess fees.

- Manufacturer Insurance (e.g., AppleCare+, Samsung Care+)

Many smartphone manufacturers offer insurance schemes like AppleCare+ or Samsung Care+. These plans are popular for their official repair services, offering high-quality repairs for accidental damage. AppleCare+ also covers loss and theft in the UK for an additional fee. However, manufacturer plans may not always cover every incident, such as cosmetic damage, and are typically more expensive.

- Third-Party Providers

Third-party insurers offer comprehensive mobile phone insurance for UK residents. These plans are often more flexible and cheaper than those provided by manufacturers or mobile networks. However, claims may take longer, and repair centres may not be authorised by your phone’s manufacturer.

Extended Warranties vs. Insurance

While extended warranties (such as those offered by retailers like John Lewis or Argos) can provide extra protection for any device faults, they do not cover theft, loss, or accidental damage. Extended warranties are more focused on defects, so they can not replace comprehensive mobile phone insurance.

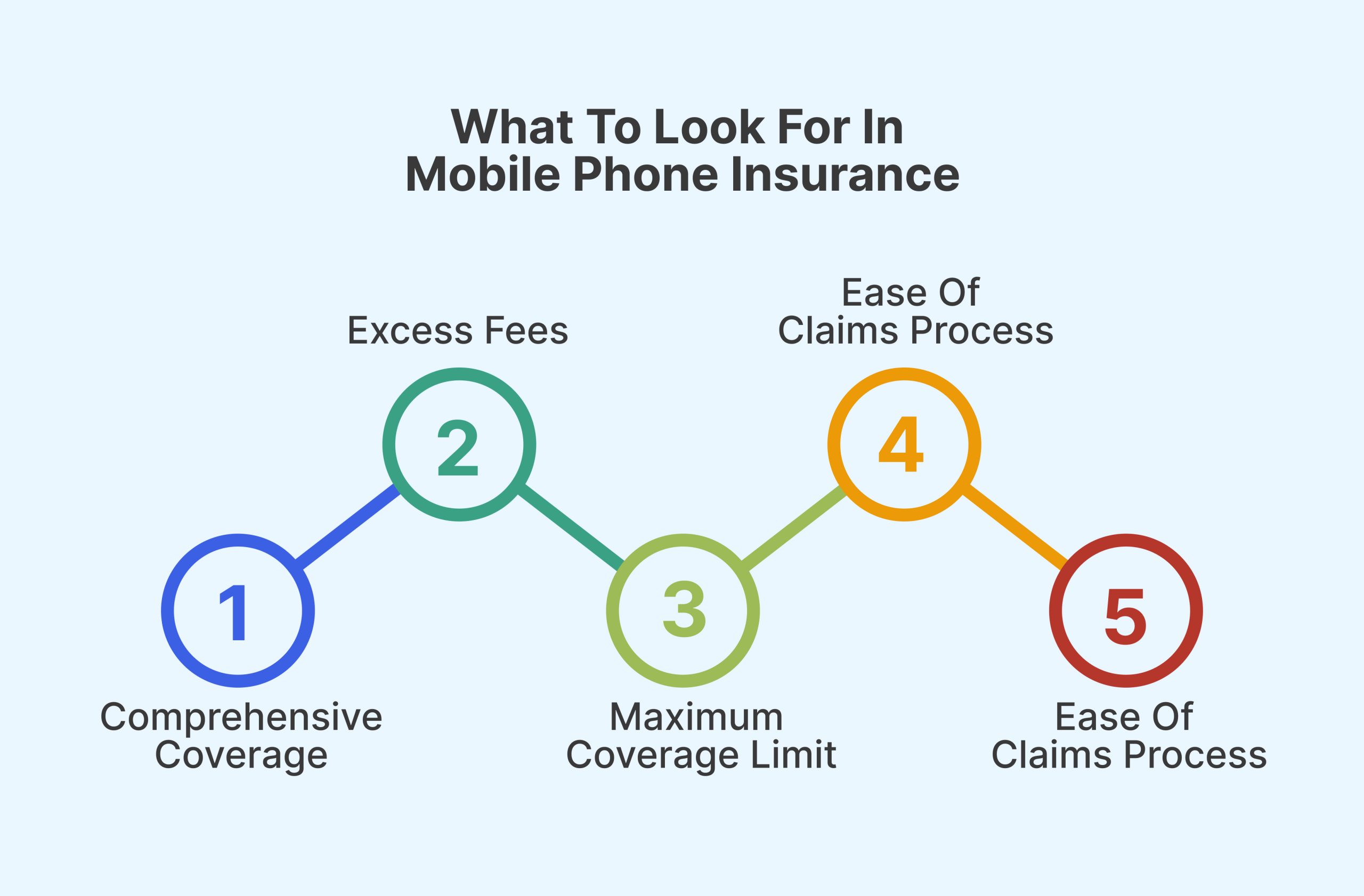

What to Look for in Mobile Phone Insurance

When choosing mobile phone insurance in the UK, here are the factors you need to consider:

- Comprehensive Coverage: The best insurance policies will cover accidental damage, theft, loss, and breakdowns. Check the terms carefully—some plans exclude water damage or limit the number of claims per year. Coverage for theft and loss is crucial, especially in larger cities like London where theft rates are higher.

- Excess Fees: The excess fee is the amount you pay out of pocket when making a claim. Insurance plans with lower premiums often come with higher excess fees. For instance, you might pay £100 excess on a policy that costs £5 per month, so it’s important to find a balance between monthly costs and excess fees.

- Maximum Coverage Limit: If you own a premium device such as the iPhone 15 or Samsung Galaxy S24 Ultra, ensure that the policy covers the full value of your phone. Some budget insurance plans may cap the payout, leaving you out of pocket if your device is worth more than the policy limit.

- Ease of Claims Process: A hassle-free claims process is important when you need a repair or replacement. Look for insurers with a solid reputation for efficient claims handling. Many third-party providers, such as Protect Your Bubble, offer online claims services in the UK, making it easier to file and track your claim.

- Worldwide Coverage: If you travel frequently, look for insurance covering your phone while abroad. Many UK policies will include international cover, but check the fine print to make sure you’re protected if you lose or damage your phone while on holiday.

How to Compare Mobile Phone Insurance Providers

- Network Providers vs. Third-Party Providers

Network providers like EE and O2 offer convenience, allowing you to add insurance to your mobile contract. However, their policies often come with higher premiums. Third-party providers like Gadget Cover or Protect Your Bubble tend to offer more affordable plans but may take longer to process claims.

- Manufacturer Plans

AppleCare+ and Samsung Care+ are ideal if you want official repairs and are willing to pay a premium. These plans are particularly beneficial if you’re already invested in the Apple or Samsung ecosystem, but they can be expensive compared to third-party alternatives.

- Standalone Insurers

Standalone insurers like Switched On Insurance or Simple Insurance often offer the most competitive premiums in the UK. These companies specialise in gadget insurance and usually provide a range of policies, from basic cover to more comprehensive plans with international protection and lower excess fees.

Factors that determine your Mobile phone insurance

Several factors will influence how much you pay for mobile phone insurance in the UK:

- Cost of Phone: The more expensive your phone, the higher your premium will be. High-end phones like the iPhone 15 or Samsung Galaxy S24 command higher insurance rates due to their high repair and replacement costs.

- Your Location: In the UK, your location affects the cost of your insurance. If you live in an area with a high theft rate, such as London or Birmingham, expect to pay more for mobile phone insurance. Rural areas tend to have lower premiums.

- Excess Fees: Higher excess fees can reduce your monthly premiums. For example, a plan with a £100 excess may have a lower monthly fee than one with a £50 excess. However, make sure the excess is affordable if you ever need to make a claim.

- Usage and Claim History: If you have claimed insurance multiple times before, you may face higher premiums. Some insurers also take into account how you use your phone—if you are more prone to accidental damage, it could affect your rates.

Steps to Filing a Mobile Phone Insurance Claim in the UK

- Report the Incident: For theft, report it to the police and obtain a crime reference number. This is a crucial step for insurance claims in the UK. For accidental damage, contact your insurer immediately to start the claims process.

- Provide Documentation: Have your proof of purchase, IMEI number, and details of the damage or theft ready. Many insurers also require photos of the damage or a copy of the police report.

- Complete the Claim Form: Depending on the provider, you can often file claims online. Some insurers also offer mobile apps for quick claims processing. Be sure to fill in all details accurately to avoid delays.

- Follow-up: Insurers may take anywhere from a few days to two weeks to process your claim. Always follow up if you don’t hear back within the expected timeframe.

Tips for Reducing Mobile Phone Insurance Costs in the UK

- Higher Excess: Opting for a higher excess can lower your monthly premiums. Just ensure it’s an amount you can comfortably pay if you need to make a claim.

- Bundle Insurance: If you have other gadgets or a home insurance policy, consider bundling your mobile phone insurance with it. Many UK providers offer discounts for multi-device or bundled plans.

- Preventative Care: Investing in a sturdy case and screen protector can help reduce the risk of damage, keeping your claim history low and premiums manageable.

Alternatives to Mobile Phone Insurance

- DIY Repairs: Some minor repairs, like screen or battery replacements, can be done at home with the help of repair kits available online. However, attempting DIY repairs can void any existing warranties, so proceed with caution.

- Self-Insurance: Instead of paying for insurance, you could save a small amount each month in case of damage or theft. This option carries some risk, but it can be cost-effective if you’re confident in taking care of your phone.

- Extended Warranties: Some retailers offer extended warranties for phones purchased in the UK. While these won’t cover theft or loss, they can extend coverage for hardware malfunctions.

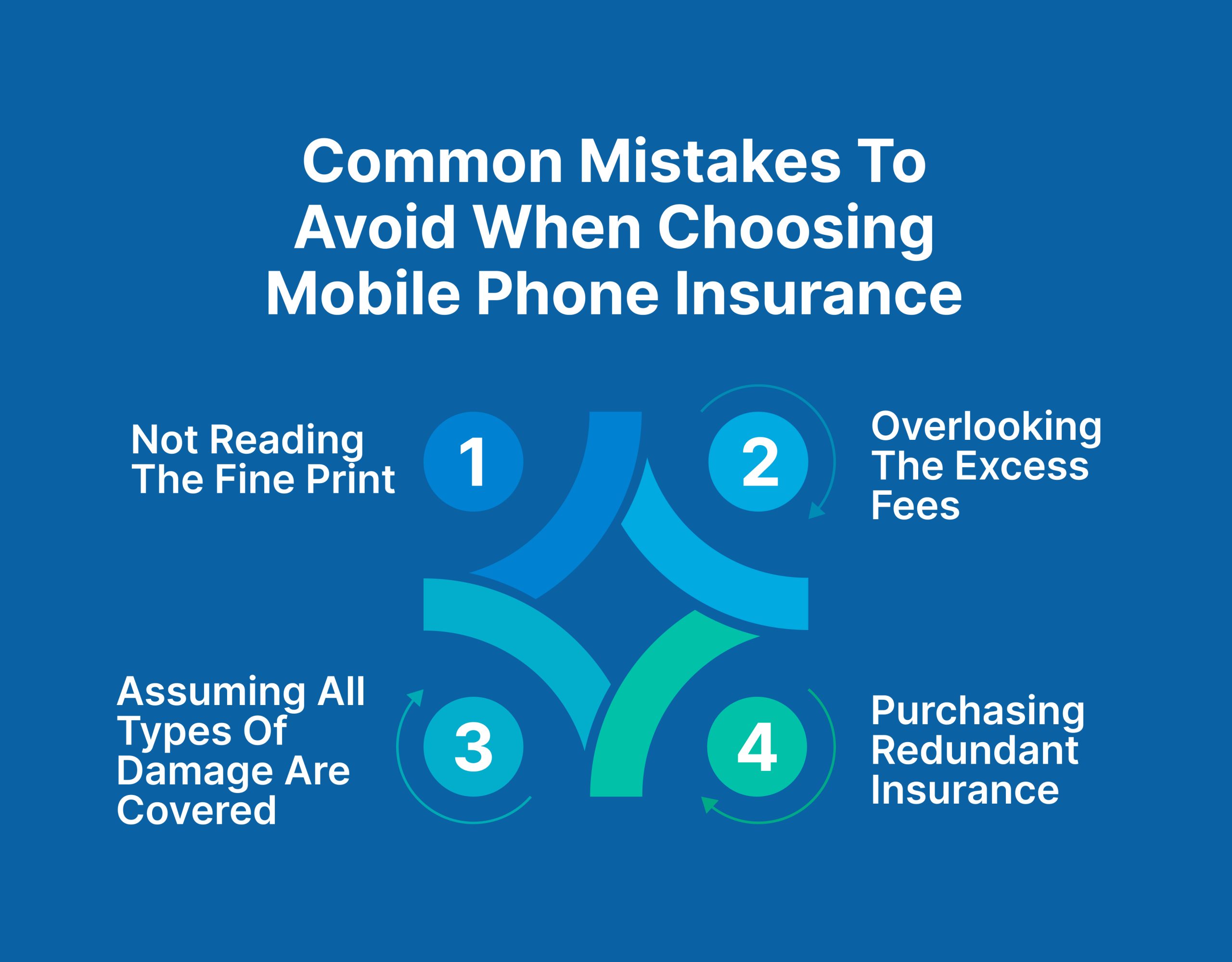

Common Mistakes to Avoid When Choosing Mobile Phone Insurance

Choosing mobile phone insurance is important to protect your device, but many people make mistakes that could cost them in the long run. Here are some common pitfalls and how to avoid them:

- Not Reading the Fine Print: Many people rush through the terms and conditions of their insurance policy without fully understanding what’s included. This can lead to surprises when you need to make a claim, like discovering that certain types of damage, such as water exposure or loss, are not covered.

Avoid this mistake by taking the time to carefully read your policy’s fine print and understand what is included, what’s excluded, and any conditions attached.

- Overlooking the Excess Fees: The amount you must pay out-of-pocket before insurance kicks in is often overlooked. Sometimes, the excess fee can be high enough that it makes smaller claims, like screen repairs, not worth pursuing through insurance.

Avoid this mistake by choosing a policy with an affordable excess fee that aligns with the value of your phone and the potential repair costs.

- Assuming All Types of Damage Are Covered: Not all mobile phone insurance policies cover every type of damage. For instance, some policies might exclude liquid damage or cosmetic damage, while others might not cover theft if it’s due to negligence (like leaving your phone unattended). You can avoid this mistake by understanding exactly what types of damage are covered, and ensuring that your policy aligns with your usage lifestyle.

- Purchasing Redundant Insurance: Many people unknowingly buy mobile phone insurance when they are already covered under another plan, like a home insurance policy or a bank account perk. Overlapping coverage means paying for unnecessary insurance. To avoid this, check whether your phone is already covered by another insurance policy before purchasing separate mobile phone insurance.

- Choosing the Cheapest Option Without Comparing Coverage: Opting for the cheapest insurance available can leave you with limited coverage or high excess fees, ultimately costing you more if you need to make a claim. Avoid this by comparing policies based on what they cover, excess fees, and customer service quality. It’s often better to pay a slightly higher premium for more comprehensive coverage.

Is Mobile Phone Insurance Worth It in the UK?

Mobile phone insurance is a great investment for mobile phone users, especially if you own an expensive phone or live in an area prone to theft. With repair costs rising and smartphones being an important part of our daily lives, having the right coverage offers peace of mind and financial protection. Before signing up, be sure to evaluate your needs, compare providers, and read the small print to find the best plan for you.

By following this guide, you will understand how to choose the best mobile phone insurance that suits your needs. With the right plan, you can enjoy using your phone worry-free, knowing you are protected from the unexpected.

FAQs

Is water damage always covered?

Water damage is not always covered under standard mobile phone insurance policies. Some insurers offer it as part of their more comprehensive plans, while others may exclude it or impose strict limits.

It’s important to:

- Read the fine print to see if water damage is covered.

- Understand what situations qualify for coverage (e.g., accidental drops vs. intentional exposure).

- Be aware of the excess fees and potential exclusions for specific scenarios, like damage caused by salt water or swimming pools.

How long will it take to process?

The time it takes to process a mobile phone insurance claim in the UK can vary, but generally, it can take anywhere from 2 to 14 days. Simple claims, such as a cracked screen, might be processed and resolved quickly, often within a few business days, especially if you use an insurer’s authorised repair service.

More complex claims, like loss or theft, may take longer due to the need for additional verification or police reports. Always submit all required documentation promptly to speed up the process.

Can I transfer my insurance to a new phone when I upgrade?

Yes, most mobile phone insurance providers in the UK allow you to transfer your policy to a new phone when you upgrade. However, there are conditions you have to fulfil such as:

- Notifying the insurer within a set timeframe after the upgrade.

- Adjusting your premium based on the value of the new phone.

- Ensuring that the new phone is still eligible for coverage (e.g., brand new and from an approved retailer). Ensure to contact your provider as soon as you upgrade to ensure continuous coverage and avoid any gaps in protection.