Mobile Phone Insurance: How to Choose the Right One

Smartphone is an essential part of your daily life and given how much you rely on them, losing or damaging them can impact your daily activity.

Find out the right mobile phone insurance to protect your smartphone!

What is Mobile Phone Insurance?

Mobile phone insurance is a type of gadget insurance that provides financial coverage in situations where your phone gets stolen, damaged, or lost. With mobile phone insurance, you do not have to worry about out-of-pocket expenses you will incur to replace your lost or repair your damaged phone.

However, it’s important to understand that even if you have a mobile warranty, you still require mobile phone insurance. A warranty only covers mobile defects for a limited period while insurance covers for as long as you want and it also offers more protection against water damage, cracked screens and any other accidental damage.

What does Mobile Phone insurance cover?

When it comes to protecting your mobile phone, there are various covers you can opt for depending on the level of protection you want and the policy available. Mobile phone insurance typically covers theft, loss and damage with the option to include policy features like phone accessories, fraud and many others. Here’s what your mobile phone insurance covers;

- Comprehensive Coverage

Comprehensive mobile phone insurance is the most extensive type of policy, offering a wide range of protection for your device. This type of insurance typically includes:

- Accidental Damage: This covers repairs or replacements if your phone is accidentally damaged, such as a cracked screen from a drop or water damage from a spill.

- Theft: Provides coverage if your phone is stolen. Some policies may require a police report to process the claim.

- Loss: This covers the cost of replacing your phone if you lose it. Not all comprehensive policies include loss protection, so it’s important to check if this is a feature.

- Mechanical or Electrical Breakdown: Extends protection beyond the manufacturer’s warranty period for issues like battery failures or other internal malfunctions.

- Unauthorized Calls and Data Use: Some comprehensive plans also cover costs incurred from unauthorized use of your phone following a theft.

2. Specific Coverage Plan

This is a type of insurance coverage that focuses solely on a cover. In this plan, you can decide to only opt for theft and lost cover. This will only cover the cost of when your phone gets stolen or lost. If you only have this cover and your smartphone gets damaged accidentally, you bear the cost out of your pocket.

Depending on your insurance provider, you can also get coverage for;

- Travel Coverage: Insurance phone coverage when you travel internationally.

- Multiple phones

- Liquid damage

- Phone Accessories

- Downloads

- The app, games, music, and other essential content

What Smart Phone Insurance does not cover?

While mobile phone insurance offers protection to your phone for loss or damage. It’s important to keep in mind that your phone insurance policy will not cover all damages – which are the exclusions. Exclusions are specific incidents your insurance company won’t take responsibility for. Being aware of these exclusions will help you avoid surprises when you need to file a claim. These exclusions include;

- Cosmetic Damage: This includes scratches, dents, or minor cosmetic damage that does not stop the phone from functioning properly. Insurance policy only covers functional damage rather than just typical wear and tear.

- Carelessness/Negligence: They are not covered as they are deemed to be avoidable damage if you are careful with your phone. Carelessness could be mishandling your phone leading to a cracked screen or leaving your phone carelessly in public.

- Delay in reporting your phone theft/Loss: Theft or loss that is not reported to the police or the insurance provider within a specified timeframe. Reporting a lost phone quickly is important to validate your insurance claim with your provider.

- Pre-Existing Damage: Damage that occurred before the insurance policy was purchased. Insurance will only give protection to damages while you are under coverage, or future incidents, not issues that already exist.

- Individuals under 18: The mobile phone will not give coverage for phones under 18 individuals. Ensure you look through the policy before taking out the cover and be sure the individual is of eligible age.

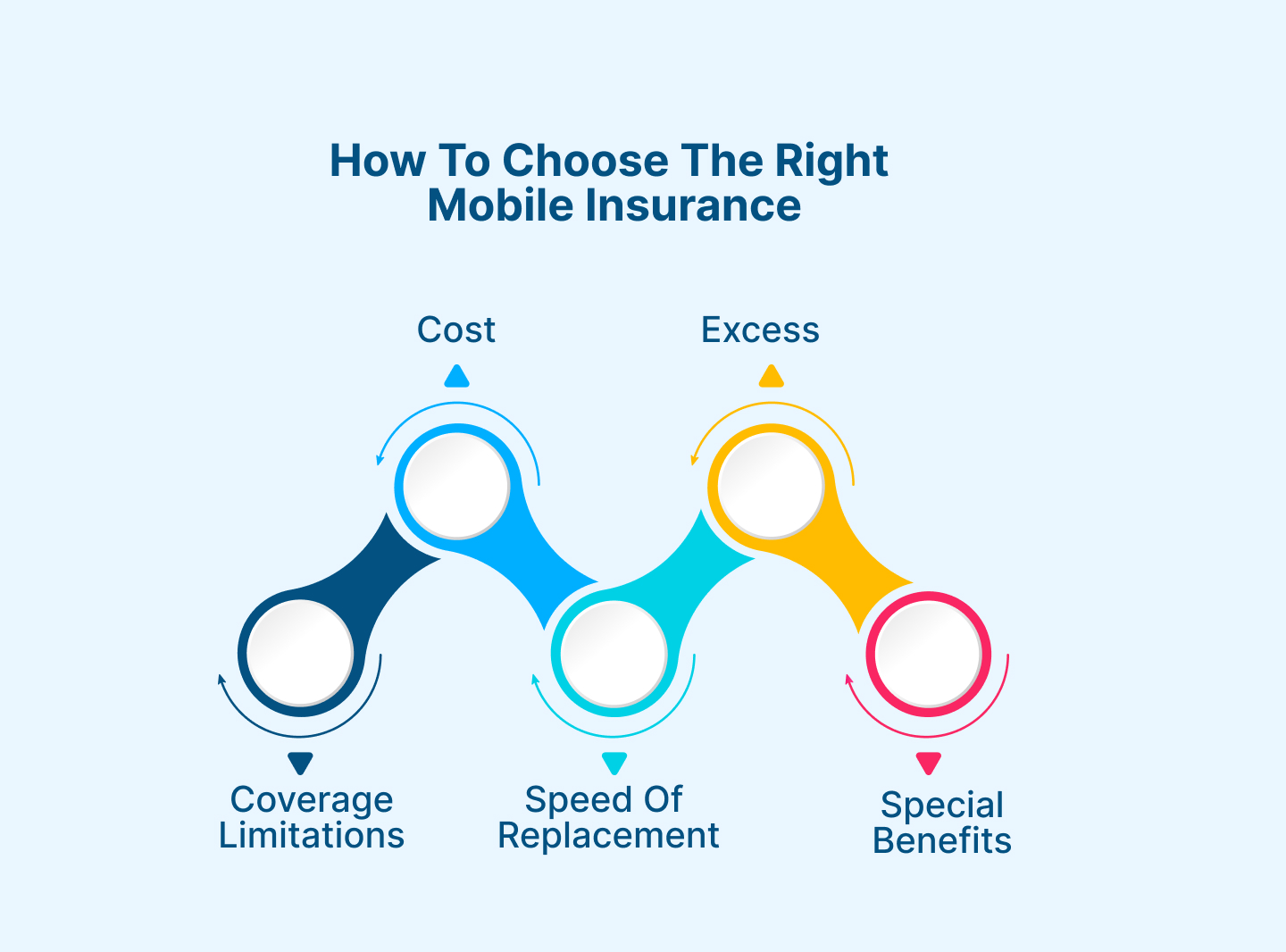

How to choose the right Mobile Insurance

To choose the right mobile phone insurance, here are the considerations you need to put in place to choose the right insurance.

- Cost: When choosing mobile phone insurance, the cost is a major factor that will influence your decision. Insurance premiums are usually charged monthly and can vary based on the value of your phone. Some policies may offer discounts for insuring multiple devices, so it’s worth checking with your provider if you are covering more than one phone.

- Excess: The excess is the amount you will need to pay out of pocket when making a claim. Typically, there’s a trade-off between the excess and your monthly premium—a higher excess might mean a lower monthly cost. Keep in mind that the excess can vary depending on the phone’s value, so consider this when selecting your plan.

- Coverage Limitations: It’s crucial to understand exactly what your insurance covers. Important factors include whether you are covered for international travel or just within your home country, whether the policy includes theft and loss in addition to damage, and whether accessories like cases or chargers are covered. Also, check if there’s a minimum contract period, a limit on the number of claims you can make, or any eligibility requirements.

- Speed of Replacement: The speed at which you can receive a replacement phone is vital, especially if you rely heavily on your device. More expensive plans might offer next-day delivery or even same-day replacements, while budget plans may take 3-5 days. Consider how quickly you’d need a replacement when choosing a plan.

- Special Benefits: Some insurance policies come with extra perks, like gifts or additional services. These benefits can add value to your plan, so it’s worth considering what extras are included when comparing options.

Why do I need Mobile Phone Insurance?

Whether you need phone insurance or not depends on individual circumstances and how much risk you are willing to take. However, with how much we rely on our smartphones to carry out daily activities, losing your phone to damage or theft means halting most activities. While it can be important, it’s unnecessary depending on individual needs. Here’s why you need a Mobile Phone insurance;

- Value of Your Phone

If you own a high-end smartphone, such as the latest iPhone or Samsung Galaxy, the cost of repairs or replacement can be quite significant. Insurance might be worth it to protect your phone investment. However, if your phone is older or less expensive, then you do not need insurance because in the long run, the cost of insurance premiums might outweigh the initial insurance benefit, especially if the phone’s market value has depreciated or does not have a significant value.

- Risk of Accidents and Damage

If you tend to drop your phone frequently or have a history of accidental phone damage, insurance could save you money in the long run by covering costly repairs. But if you are careful with your devices and rarely don’t have any phone damage, then it might be helpful to skip opting for an insurance and rely on your track record of being a careful phone user.

- Ability to Replace or Repair Out-of-Pocket

If you find it hard to pay for the repair or replacement of your phone out-of-pocket, then insurance could be a smart option to opt for to be protected from unexpected expenses. But If you are a careful saver and can easily cover the cost of a new phone, you might decide that insurance isn’t necessary.

- Peace of Mind

For some, the primary benefit of phone insurance is peace of mind. Knowing that you are covered in case something goes wrong is reassuring, especially if you heavily rely on your phone for work or personal matters. If you’re comfortable taking the risk and feel that you’re unlikely to need to file a claim, you might prefer to save the money you would spend on premiums.

Alternatives to Mobile Phone Insurance

- Extended Warranties: Some people opt for extended phone warranties that cover mechanical breakdowns, which can be a cheaper alternative if you’re mainly worried about your phone malfunctioning after the manufacturer’s warranty expires.

- Self-Insurance: Setting aside money in a savings account as a self-insurance fund can be another option. This way, you have money available for repairs or a replacement if needed, without paying monthly premiums. While this can be a fallback option when you misplace or damage your phone, you may want to consider;

- If you do not have enough money saved up when a mishap occurs or when you lose your phone.

- You incur the cost of unauthorised calls before you get to report your stolen phone. Therefore if you intend to self-insure, make sure your money is where you can access it easily.

- Credit Card or Packaged Bank Account: Some credit cards or packaged bank accounts offer complimentary mobile phone insurance as a benefit, which might make purchasing additional coverage unnecessary. By opting for this;

- You have a cheaper way of insuring your phone

- If you operate a joint account, you can insure multiple phones at the same price.

Conclusion

Choosing the right mobile phone insurance is an important decision that can provide you with financial protection. If you heavily rely on your smartphone for both personal and professional use, then ensuring that you are covered against unexpected accidents, theft, or loss is important. By understanding what mobile phone insurance covers, weighing the costs, and considering your specific needs and risks, you can make an informed choice that best suits your lifestyle.

With the right insurance, you can save time, money, and stress, allowing you to use your smartphone with no worries. Take the time to assess your options and choose a policy that aligns with your needs, so you can stay connected without worrying about the “what ifs.”

FAQs

- Do I Need Mobile Phone Insurance If I Have a Warranty?

Warranties typically last between 12 and 24 months and cover repairs for damage that isn’t your fault. However, they may not cover all types of repairs—such as only offering battery replacement for a portion of the warranty period.

- How Long Will It Take to Get a Replacement Phone?

Some insurance policies offer instant coverage, meaning you can receive a replacement phone within standard delivery times, usually three to five working days. However, certain policies have a waiting period before you can make a claim, which may prevent you from filing one immediately after purchasing the coverage.

- How Do I Make a Claim on My Mobile Insurance?

To file a claim on your mobile insurance, you can usually do so through the insurance provider’s website or by phone. The provider will guide you through the next steps, including what documentation is needed and how long your phone may be required for repairs. Most insurers require you to report the issue within 48 hours of discovering it.

If your phone is lost or stolen, it’s advisable to notify your insurance provider within 24 hours. You should also inform your network provider so they can block any unauthorized activity on your phone.

- Can I Add Other Gadgets to My Mobile Phone Insurance Policy?

Yes, you can insure your phone along with other gadgets through a bundled gadget insurance policy, even if your devices are refurbished. If you have a mobile phone, laptop, or tablet, you might want to cover all your devices under one policy