Mobile phones have become indispensable tools for communication, work, entertainment, and staying connected with the world. Given their critical role and the significant investment they represent, securing mobile phone insurance is a wise choice. However, to fully reap the benefits of mobile phone insurance, it’s crucial to understand the fine print and limitations of the policy you choose. This article will help you navigate the intricacies of mobile phone insurance, ensuring you are well-informed about what is and isn’t covered, so you can make the most of your coverage.

The importance of mobile phone insurance

Mobile phone insurance provides coverage for various incidents such as accidental damage, theft, and sometimes loss. It helps mitigate the financial burden associated with repairing or replacing your device. As smartphones become more sophisticated and expensive, the potential cost of damage or loss increases, making insurance an attractive option for many users. However, the value of this insurance depends largely on understanding the specifics of the policy.

Reading the fine print: key terms and conditions

The fine print of an insurance policy contains crucial information that dictates the scope of coverage, exclusions, and the process of making claims. It’s essential to thoroughly read and understand these details to avoid surprises when you need to use your insurance. Here are some key elements to focus on:

Coverage limits

Coverage limits specify the maximum amount the insurer will pay for a claim. This limit can be for a single incident or over the life of the policy. Understanding these limits helps you know how much financial protection you truly have. For instance, if your phone is worth $1,000 but the policy covers only up to $500 per claim, you will need to cover the remaining cost yourself.

Deductibles

A deductible is the amount you must pay out-of-pocket before the insurance coverage kicks in. Policies with lower monthly premiums often come with higher deductibles. When evaluating a policy, consider whether the deductible is affordable and reasonable relative to the potential repair or replacement costs.

Policy exclusions

Exclusions are conditions or circumstances that are not covered by the insurance policy. Common exclusions in mobile phone insurance include:

- Intentional Damage: Damage resulting from deliberate actions.

- Cosmetic Damage: Scratches or dents that do not affect the functionality of the device.

- Manufacturer Defects: Issues covered by the manufacturer’s warranty.

- Pre-Existing Conditions: Damage or issues that existed before the insurance policy was purchased.

Understanding these exclusions is vital to avoid filing claims that will be denied and to ensure you’re aware of the actual coverage provided.

Common limitations in mobile phone insurance

While mobile phone insurance offers valuable protection, it’s important to be aware of its limitations. These limitations can affect the ease and success of your claims.

1. Claim limits

Many policies impose a limit on the number of claims you can make within a certain period, typically a year. Exceeding this limit means any additional claims will not be covered, even if they fall within the other coverage terms. For instance, if your policy allows two claims per year and you’ve already filed two, a third incident will be out-of-pocket.

2. Depreciation

Insurance payouts often take into account the depreciation of your phone’s value over time. This means the reimbursement amount may be less than the original purchase price, reflecting the current market value of a used device. Understanding how depreciation is calculated and applied can help set realistic expectations for claim settlements.

3. Replacement conditions

If your phone needs to be replaced, the insurance company may provide a refurbished model rather than a brand-new one. Additionally, the replacement might be a similar model rather than the exact one you originally owned. Knowing these conditions in advance can help you understand what to expect in the event of a claim.

4. Authorized repairs

Insurance policies often stipulate that repairs must be carried out by authorized service providers. Using an unauthorized repair service can void your coverage. Ensure you know the approved repair centers and follow the correct procedure to maintain your insurance validity.

How to evaluate mobile phone insurance policies

Evaluating mobile phone insurance policies requires a thorough comparison of the terms, coverage, and costs. Here are some steps to help you make an informed decision:

1. Compare coverage: Examine what each policy covers, including accidental damage, theft, and loss. Look for additional benefits such as international coverage or protection for accessories. Ensure the policy aligns with your needs and the risks you’re most concerned about.

2. Assess costs: Consider both the monthly premiums and the deductibles. A lower premium might be attractive, but ensure the deductible is affordable. Calculate the total potential cost of ownership, including out-of-pocket expenses for claims.

3. Review claim process: A straightforward and efficient claim process is essential. Look for policies with clear instructions, reasonable claim approval times, and good customer service. Reading reviews and testimonials can provide insight into the claim experience of other customers.

Understand exclusions and limitations

Pay close attention to the exclusions and limitations of each policy. Ensure you are comfortable with the conditions and aware of any potential gaps in coverage. This understanding will help prevent disappointment and frustration when filing a claim. Additionally, it’s wise to periodically review these exclusions and limitations as policies can change over time, especially upon renewal. Being proactive about understanding the fine print will allow you to make informed decisions about whether your current insurance still meets your needs or if it might be time to seek a policy with better terms.

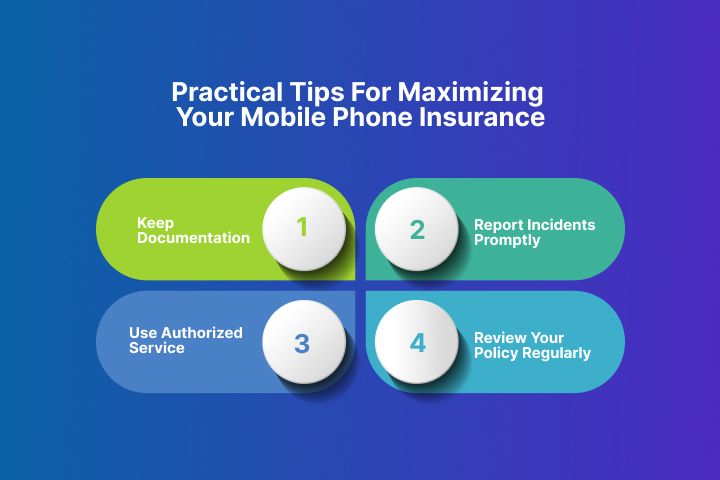

Practical tips for maximizing your mobile phone insurance

To make the most of your mobile phone insurance, follow these practical tips:

1. Keep documentation: Maintain all documentation related to your phone, including the purchase receipt, insurance policy details, and any repair records. This information will be essential when filing a claim.

2. Report Incidents Promptly: In the event of damage, theft, or loss, report the incident to your insurance provider as soon as possible. Delays in reporting can complicate the claim process and may result in denial of coverage.

3. Use Authorized Service: Always use authorized repair services for any necessary repairs. This ensures that the repairs meet the insurer’s standards and keeps your coverage intact.

4. Review Your Policy Regularly: Regularly review your insurance policy to ensure it continues to meet your needs. If you upgrade to a new phone, update your policy to reflect the change. Ensure your coverage limits and terms are still appropriate.

Understanding policy renewal cancellation

Mobile phone insurance policies typically require renewal on an annual basis. Understanding the renewal and cancellation terms is important to maintain continuous coverage and avoid unexpected lapses.

Renewal Terms

Insurance providers often send renewal notices before your policy expires. Review these notices carefully to understand any changes in terms, coverage, or premiums. Consider whether you want to renew the policy or explore other options.

Cancellations Policy

If you decide to cancel your insurance, be aware of the cancellation terms. Some providers may charge a fee for early cancellation, while others might offer a prorated refund. Understand the process and any financial implications before cancelling your policy.

The role of warranties vs. insurance

It’s important to distinguish between warranties and insurance, as they serve different purposes. A warranty typically covers manufacturer defects and mechanical failures within a specified period. Insurance, on the other hand, covers accidental damage, theft, and loss. Both can be valuable, but they are not interchangeable.

Manufacturer’s Warranty

Most new phones come with a manufacturer’s warranty that covers defects and malfunctions. This warranty is usually valid for a year and does not cover accidental damage or loss. Extended warranties can be purchased for additional coverage.

Insurance Coverage

Mobile phone insurance complements the manufacturer’s warranty by covering incidents that the warranty does not, such as accidental damage and theft. Understanding the distinctions between these two types of coverage ensures you have comprehensive protection for your device.

Real-life scenarios: applying your knowledge

Let’s consider some real-life scenarios to illustrate how understanding the fine print and limitations of mobile phone insurance can make a difference:

Scenario 1: Accidental Damage

Imagine you drop your phone, cracking the screen. You file a claim with your insurance provider, only to find out that the deductible is $200, which is half the cost of the repair. Had you been aware of the deductible, you might have reconsidered the insurance policy or chosen a different one with a lower deductible.

Scenario 2: Theft

Your phone is stolen while you’re traveling abroad. You report the theft and file a claim, but the policy excludes international incidents. Understanding the coverage limitations beforehand could have prompted you to purchase a policy with global coverage or taken extra precautions while traveling.

Scenario 3: Multiple Claims

You’ve already filed two claims within the policy year, and your phone is damaged again. The insurance provider denies your third claim due to the claim limit. Knowing the claim limits would have prepared you for the possibility of having to pay out-of-pocket for additional incidents.

Conclusion

Mobile phone insurance can provide valuable protection against unexpected expenses, but it’s crucial to understand the fine print and limitations of your policy. By carefully reviewing the terms and conditions, exclusions, coverage limits, and claim processes, you can choose the best policy for your needs and avoid unpleasant surprises. Stay informed, keep detailed records, and regularly review your policy to ensure it continues to meet your needs. With this knowledge, you can confidently navigate the world of mobile phone insurance and safeguard your valuable device.